The Kaohsiung National Taxation Bureau of the Ministry of Finance stated that the deadline for declaration of 2011 annual withholding certificates, withholding certificates, various income certificates of trust property, and dividend certificates is February 6, 2012, and the online declaration is until 12:00 midnight on the same day.

The bureau further clarified that in accordance with Article 89, Item 3, Article 92, Article 92-1, and Article 102-1 of the Income Tax Law, withholding agents, trustees and profit-seeking enterprises should file a For various types of income withholding and withholding exemption vouchers and dividend vouchers and other vouchers issued by the taxation agency in the previous year, the reporting period is extended to February 6, 2012 because January 2012 is a national holiday for more than 3 consecutive days.

The bureau reminded that if the withholding unit declares the voucher within the prescribed time limit and the income person contained in it is an individual residing in the territory of the Republic of China, the regulations on issuing the voucher can be exempted. If you declare online, you only need to fill in the voucher in the declaration system If you check the "free delivery" or "e-voucher" option, you no longer need to send a paper voucher to the beneficiary. However, when the beneficiary requests to fill in and issue the voucher, the voucher declarer should still fill in and issue the voucher.

The National Taxation Bureau once again called for the Internet to replace the road, which not only saves time and paper, but also achieves the purpose of energy conservation and environmental protection. For more information, please visit the Bureau’s website (https://www.ntbk.gov.tw)/Theme Zone/Tax Zone/Income Tax Category/Income Tax Voucher Exemption Zone.

Provider: Review Section 2 Contact Person: Section Chief Chen Yanling Contact number: (07)7256600 extension 7200

Contributor: Wu Peiying Tel: (07)7256600 extension 7217

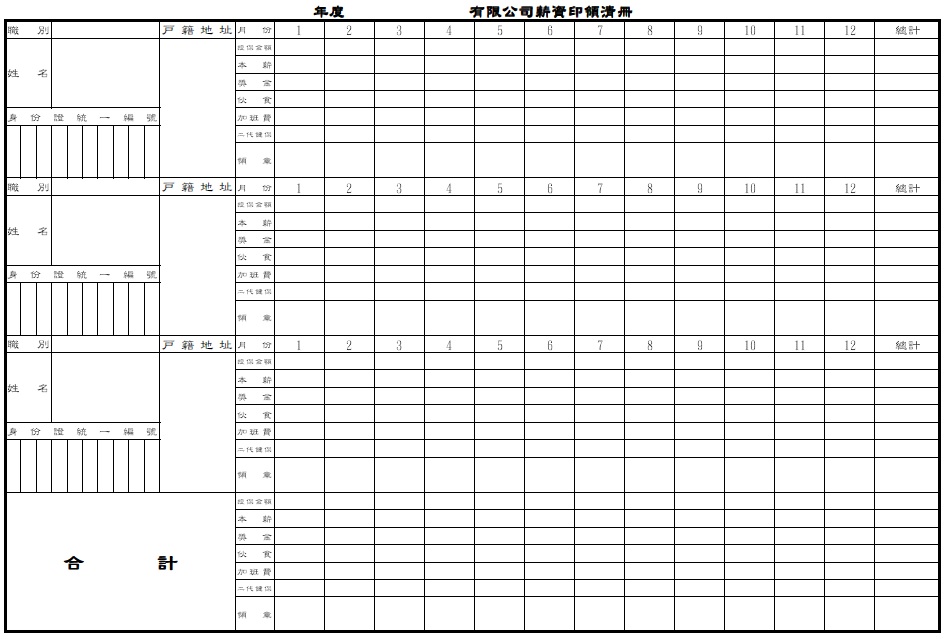

Before January 31 every year, Jingxun Accountants will ask your company to provide, and discuss the salary of employees in the previous year,

Shareholder dividends (two taxes in one), rent, business execution and other income, as well as second-generation health insurance fees payable, etc.,

Then report to the Internal Revenue Service and the Health Insurance Bureau by electronic transmission.

Those who fail to declare all kinds of income withholding overdue will be fined by the National Taxation Bureau, so we have to be careful.

Salary Income Definition:

All employment income, labor service remuneration based on employment relationship;

(71 salary expenditure, 74-3 travel expenses, 75-2 shipping expenses, 83-5 insurance premiums, 86-4 research expenses, 1-1 training expenses of 86):

(1) Employing persons qualified to perform business:

The labor services it provides are specific and cannot perform business independently, and often require the service unit to be lazy and check on work attendance.

Remarks: In the employment relationship, the employee serves the employer. Without the consent of the employer, the right to request labor services shall not be transferred to a third party, nor shall the third party be used to perform labor services without consent.

Usually, it is paid on a time-by-hour basis, and if it is not completed or has no expected effect, it should still be paid. However, there is also an agreement to pay on a piece-by-piece basis, depending on the achievement of the event and the completion of the work.

(2) Remuneration paid by insurance companies to insurance salespersons:

Although the payment is based on solicitation results, insurance salesmen should only engage in insurance solicitation for their companies in accordance with the provisions of the insurance salesman management rules.

And accept the management of the company and receive the remuneration according to the salesman management method and remuneration payment standard stipulated by the company, so the remuneration received in this item is still the salary income for providing labor services at work,

It is not income from performing business.

In addition, the necessary expenses incurred by insurance salespersons for soliciting insurance business for their companies belong to the operating expenses of insurance companies and should not be directly included in the salary income of insurance salespersons.

(3) Health check fee:

A. Expenses borne by employers for regular health checkups for employees or those engaged in operations that are particularly harmful to health in accordance with the Labor Safety and Health Law are not considered as salary income for employees;

B. The medical subsidy and health examination fee received or paid by the employee from the service unit belong to the subsidy obtained on the job and shall be included in the salary income of the employee.

(4) Non-fixed salary:

Non-fixed salaries received by individuals living in the Republic of China, such as additional bonuses for three quarters, replacement pay for upgrades, marriage, childbirth, education subsidies,

Employee bonuses (if it is a capital increase and allotment of non-suspended classes, it should be calculated at face value, and the ex-right date is the date of income realization) or directors and supervisors' remuneration, etc., are not fixed every month.

5% should be withheld. If it is combined with the salary payment of the current month, it can also be withheld by checking the table. The part-time salary income obtained by the salary recipient who works concurrently in other institutions outside the institution,

5% shall be withheld. (From January 1, 2000, those who do not reach the withholding standard of the salary income withholding tax table without a spouse and dependent relatives will be exempted from withholding. (Article 8 of the salary income withholding method))

(5) Travel expenses, daily expenses and overtime pay do not exceed the prescribed standards:

For the purpose of the employer, the travel expenses, daily expenses and overtime pay paid for the performance of duties, which do not exceed the prescribed standard, shall not be included in income taxation. Travel expenses and daily expenses are generally in accordance with the standards of civil servants on business trips.

A. Meal and miscellaneous expenses standard for domestic business trips, the chairman, general manager, and factory director are 700 yuan per person per day, and other employees are 600 yuan.

B. Accommodation and miscellaneous expenses for foreign business trips shall be compared with the standards for civil servants, but there is a way to verify and reimburse the accommodation expenses by themselves.

C. According to the provisions of Article 24 of the Labor Standards Act, "Wages for extended working hours" and Article 32, "Total extended working hours on weekdays per month"

(The employer's extended working hours and normal working hours shall not exceed 12 hours a day, and the extended working hours shall not exceed 46 hours a month). Overtime pay received within the limit is exempt from income tax.

D. Although the normal working hours of national holidays, public holidays (shift system, one day off every 7 days), and special holidays are also considered overtime, they are not counted in the total hours of the above-mentioned tax exemption standards.

E. To report overtime pay, you must have the fact of overtime work before you can issue the account, otherwise the expense will be removed. If necessary, check the overtime card, turnover, and production records.

(6) Those who withhold tax according to the salary income withholding table:

The Tax Allowance Declaration Form (Appendix 1) must be completed. Those who do not fill in the form should be treated as if they have no spouse and no dependent relatives. However, employees with high salaries can also choose to withhold 5% at their own discretion.

(7) Salary received abroad:

A. The employees sent by the company to serve in foreign branches, the salaries of labor services provided abroad, are not derived from sources within the territory of the Republic of China, and are not subject to tax, and the settling expenses are also tax-free.

B. However, if there is no branch abroad or the stationing abroad is not for undertaking foreign mechanical installation projects and technical services, it is only for business trips and should not be tax-exempt.

C. However, 5% income tax will be withheld for the part of the salary received by the government sent by the government personnel stationed abroad, based on the total monthly payment exceeding 30,000 yuan.

(8) Group life insurance purchased by the company for employees:

The insurance premiums borne by the company can be beneficiaries of profit-making enterprises or insured employees and their families. The monthly insurance premium per person is within 2,000 yuan, which is exempted from being regarded as employee salary income.

The excess should be regarded as subsidy in disguised form and transferred to employee salary income for taxation. However, the insurance premiums for public and labor insurance that are borne by service organizations are exempted from being regarded as salary income of employees.

(9) Employment of foreign employees:

If the period of validity of the employment contract, working period, residence permit, and passport has exceeded 183 days, unless the first year is employed in the second half of the year, it can be withheld from the beginning as a resident.

(10) If the foreign parent company pays the salary of the foreign personnel of the Taiwan subsidiary on behalf of the Taiwan subsidiary and the Taiwan subsidiary bears the expenses, it shall withhold the salary income tax when the notice is listed.

(11) Research fee:

The payment unit designates the topic, and the researcher conducts research, provides the research grant for the research report, or pays the research fee according to the monthly fixed amount during the research period.

All of them are remuneration for providing labor services to the paying unit, and are the salary income of researchers. If personnel and administrative expenses are stipulated in the project research contract, the personnel expenses are the salaries of the recipients participating in the research, and the administrative expenses can be evidenced written off by the accounting unit.

(12) Remuneration of directors and supervisors:

Shareholders of a legal person send staff to serve as directors and supervisors. The traveling expenses and remuneration of directors and supervisors received by the legal person are salary income, and income tax shall be withheld at 5% (non-operating income, uniform invoice is not required).

(13) Self-withdrawal pension:

Laborers, employers who are actually engaged in labor, and employees of nationalities or appointed managers who are not applicable to the Labor Standards Act and who have agreed to contribute pensions to them with the employer's consent, within 6% of their monthly wages,

The retirement amount that is voluntarily contributed separately is exempted from being included in the total salary income for taxation. When the withholding agent fills out the deduction (exemption) payment voucher according to law,

It is only necessary to fill in the contribution amount separately in the "Retirement Amount Voluntarily Contributed According to the Labor Retirement Act" column of the deduction (exemption) payment voucher, and it is exempted from being included in the "Total Benefits" of salary income.

(14) Employee dividends:

The dividends and allotment of shares obtained by employees in accordance with Article 19-1 of the Regulations on Promotion of Industrial Upgrade are salary income, and the withholding agent shall calculate the "total payment" of salary income based on the number of allotted shares and the face value of the shares.

The difference between the current price of the stock and the day after the day when the stock can be disposed of exceeds the face value shall be reported in the "Salary Income Withholding and Withholding Exemption Receipt" specially used for employee dividends and stock allocation.

(15) How to distinguish the hourly fee for lectures from the hourly fee for teaching

(Taoyuan News) The National Taxation Bureau of the Northern District of Taiwan Province of the Ministry of Finance stated that the remuneration received by individuals invited to lectures at public and private institutions, groups, businesses, and schools at all levels should be classified as hourly lecture fees or hourly lecture fees.

It is related to whether income tax can be exempted within the range of 180,000 yuan, and the explanation is as follows:

1. The hourly fees paid by public and private institutions, organizations, enterprises, and schools at all levels for hiring scholars and experts to give lectures are part of the hourly fee income for lectures stipulated in the Income Tax Law and are exempt from income tax.

However, if the total amount of manuscript fees, royalties, music scores, composers, screenwriters, comics, etc. exceeds NT$180,000 for the whole year, this restriction does not apply.

2. Public and private institutions, groups, undertakings and schools at all levels hold courses or hold various training courses, lectures, and other similar activities, and hire lecturers to teach courses,

The hourly fee paid is salary income. The teaching personnel are not limited to those who have the status of teachers.

Jingxun United Accounting Firm, Datong District, Taipei City calls on the withholding agent to pay the above-mentioned income. When declaring the withholding or withholding exemption certificate, the former should check the income from the execution of business;

The latter is salary income. If you find that there is an error in the declaration, please go to the branch office or tax collection office under your jurisdiction to correct the withholding voucher as soon as possible.