A business person who declares business tax online should pay attention to whether the declaration materials have been uploaded successfully

The Taipei National Taxation Bureau of the Ministry of Finance stated that it is time-saving and convenient for business owners to declare business tax online. More and more business owners have adopted the online method of declaration, but they should pay attention to whether the declaration materials have been successfully uploaded or not.

According to the Bureau, according to Article 35 of the Value-Added and Non-Value-Added Business Tax Law, regardless of whether the business has sales or not, it shall take every two months as a period, and within 15 days from the beginning of the next period, fill in the declaration form in the prescribed format, Submit the tax refund and other relevant documents, and declare the sales amount, payable or overpaid business tax to the competent tax authority. If there is a payable business tax, it should be paid to the public treasury first, and then submitted together with the payment receipt. . If a business person declares and pays business tax online, it should still complete the declaration within the reporting period stipulated above.

The bureau gave an example. Company A failed to file a business tax declaration for March to April 2011 within the prescribed time limit. After the bureau notified the salesperson to make a supplementary declaration, Company A discovered that although there was a credit card tax payment record for that month, Company A had not uploaded the declaration materials. Once completed, you will leave the electronic business tax declaration system, resulting in an unfinished business tax declaration, and you will be charged a late fee of 1,800 yuan.

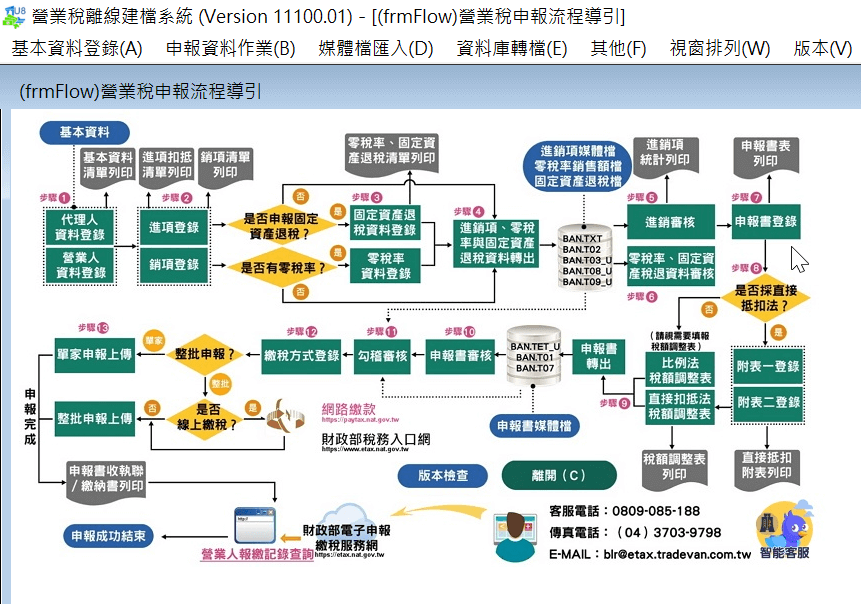

The bureau appealed that tax payment is only part of the declaration process. The completion of the so-called online declaration is not just tax payment. The declaration data should be transmitted to the platform designated by the tax collection agency. After the platform accepts it, "Thank you Use the business tax electronic declaration system. If the declaration is successful, please print and keep the receipt. If you have unpaid taxes, please go to the financial institution to pay within the payment deadline." The message is uploaded successfully, and the receipt is printed or saved You can also connect to the Ministry of Finance's electronic tax declaration and payment service network to check the tax declaration records to confirm whether the declaration has been completed.

(Contact person: Auditor Li from the first legal department; telephone 2311-3711 extension 1859)